|

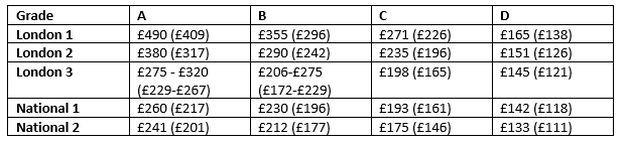

Paul Cruickshanks of A&M Bacon offers some words of hope and caution on claiming enhanced rates following the recent decision in PLK & Others For court appointed deputies and those assisting professional deputies, you will have no doubt read the judgment that was handed down at the end of September 2020. If, for some reason, you haven’t seen or heard of this judgment, the case; PLK and Others [2020] EWHC B28 (Costs) can be found here. It is well worth a read. So, what is all the fuss about? Well, as many of you will be aware, the Court of Protection Section of the Senior Courts Costs Office (SCCO) has for many years now applied the Guideline Hourly Rates for Summary assessment on the vast majority of the 8,000 or so bills of costs it assesses each year. Whilst there are cases where appropriate uplifts can be applied (and indeed are allowed), for the majority the guideline hourly rates (GHR) have been applied. Unfortunately for practitioners the GHR have been in place since 2010 and it is over ten years since these rates have been reviewed. As a result, we are starting to see various comments made by costs judges in relation to the validity of such rates. The case of PLK and Others is, in our view, a landmark decision and timely. Put simply, this case enables deputies to enhance their rates by up to 20%. Judgment was reached as a result of the consideration of evidence relating to increasing overheads and inflation. The following table shows the impact of these enhancements and details what professional deputies may seek to recover (subject to the further information set out below); the traditional GHR are shown in brackets:- There was great excitement amongst practitioners following the handing down of the judgment. Not only did the judgment confirm these hourly rates would be considered to be “prima facie” reasonable, it also confirmed this approach could be “adopted immediately and be applied to all outstanding bills regardless of the whether the period is to be 2018, 2019, 2020 or subsequently”. However, in the days that followed, the SCCO sought to rein in our excitement….. Letter from the Senior Costs Officer – Ms Helene Maxwell The very next day, a letter was sent to professional deputies to remind them of their obligations towards their clients. A stark reminder was provided; the indemnity principle still applies! Therefore, for these new rates to apply, one can only do so if the terms of business under which the work is being undertaken accommodates these higher rates. For example, you could not charge a rate of £260, if your terms only allow for a rate of £217 to be charged. The letter went on to advise practitioners that any bills of costs currently filed with the court (i.e. awaiting assessment) could not be withdrawn and appeals were unlikely to be successful (where final costs certificates had not yet been obtained) where the “old” GHR were applied. Practice note from Senior Master Gordon-Saker This letter was swiftly followed up by a practice note, which essentially reinforced the above from Ms Maxwell. Para. 3 of the practice note stated the indemnity principle needs to apply. Para. 4 advised that practitioners would not be permitted to withdraw or amend bills of costs awaiting assessment without an application to a costs judge (such application having to be made on N244), which must also include evidence the indemnity principle has not been breached (presumably a copy of the terms and conditions of business). Para. 5 went on to advise that appeals seeking to apply the higher hourly rates in relation to bills previously assessed (via the informal appeal route) would be unlikely to succeed. The practice note goes on to advise Costs Officers will continue to have regard to Terms and Conditions of business and the estimates provided to the OPG in the OPG105 document. Tips for ensuring your rates are maximised It occurs to us a few interesting points arise from this further guidance. It is interesting the court has raised the issue of the terms of business enabling these rates to be applied. Many firms for whom we undertake work have a practice of providing terms to their deputies (often the deputies are, in effect, writing to themselves!). Given the deputy’s role as such and the fact they are also the practitioner, the deputy would know the rates (s)he wishes to charge. An interesting point for discussion. In any event, our first tip here is to update your current terms to enable these enhanced rates to be claimed. It may also be worth bearing in mind that there could be future changes on the horizon to hourly rates, given the review that is currently ongoing at the time of writing (October 2020). Whilst we wouldn’t want to count our chickens, it may be worthwhile considering the hourly rates you wish to detail in your terms to ensure you can take full advantage of any future increases. We would suggest updated terms be prepared sooner rather than later to maximise your increase. Be mindful of the indemnity principle. The court may request evidence to support higher rates being claimed. One further tip here is to also review your OPG105 Estimates. If you are to apply higher rates part way through a deputyship year, what impact will this have on your estimate? If your terms support a higher rate and you are going to seek them for the duration of the deputyship year, does your estimate need to be updated? It is also worth bearing in mind the impact this decision will have in relation to any ongoing litigation that may be associated with your deputyship. Do you need to update your schedule of loss to factor in increased deputyship costs? Conclusion There can be no denying the judgment in PLK and Others is good news for professional deputies and those engaged in Court of Protection work alike. In our view, these rate increases are long overdue. However, given the guidance and further information provided by the SCCO immediately following the judgment, our advice is to exercise caution when deciding upon your hourly rate to be claimed within the bill of costs. Check your terms and update them if needed. Check your estimates and contact the OPG without delay if increases to those estimates are required. The impact is positive, but one must remain vigilant to ensure one can take advantage of this new case law.  Paul Cruickshanks, A & M Bacon, [email protected] Paul Cruickshanks, A & M Bacon, [email protected] Article updated 16/11/2020: two of the old rates set out in the table above were incorrect: London 1 B and London 3A

Comments are closed.

|

Stay up to date with changes to policy and procedure.

Sign up for our free email alertWe do not share your details with any third parties and you can unsubscribe at any time.

More from Bath PublishingBrowseCategories

All

Archives

September 2023

|

|

This site is published by Bath Publishing Limited

www.bathpublishing.com Manage your email preferences Read the Bath Publishing Privacy Policy |

RSS Feed

RSS Feed